< Back to Learning & Insights

Market Commentary – January 2024

Trevor Hubner, Investment Manager at MKC Invest, suggests that although the potential for slightly lower interest rates had a positive impact on bond and equity markets at the end of 2023, the move away from no- or low-cost borrowing is a more rational approach. However, given the various geopolitical factors now in play, market conditions in 2024 are hard to predict.

The final quarter of 2023 saw markets rebound strongly after the disappointment of Q3. The main reason for this improved sentiment was better inflation data leading to speculation as to when central banks would finally perform their much-anticipated pivot and begin the process of moving interest rates lower. Although it does appear that we have indeed seen the peak in this rate hiking cycle, it is also true that 2023 saw several false dawns and short-lived optimism.

The year can be broken into distinct periods. It began with markets rising on the hope that inflation would quickly roll over and lower interest rates would follow relatively soon. This optimism faded through February as data showed inflation remained sticky and employment levels remained elevated and nervousness increased in March when Silicon Valley Bank collapsed, swiftly followed by Credit Suisse. It must be acknowledged that having been criticised for being slow to recognise the danger of inflation in 2021, central banks reacted swiftly and decisively during this challenging period. Their actions were extremely well received and limited contagion across the wider banking sector.

“Higher for longer” mantra accepted by September

The summer months saw sentiment fluctuate as markets were buoyed by improved inflation figures, but then disappointed as economic data remained strong, leading to the suggestion that interest rates would indeed remain elevated for a period, certainly beyond the forecasts from earlier in the year. By September the market finally started to believe the “higher for longer” mantra that central banks had been pushing and the timeline for expected rate cuts retreated towards the end of 2024 or later. This also concentrated minds on the additional cost of government borrowing at these levels, leading to questions over the ability of even the best-rated countries being able to raise funds. These concerns led to borrowers wanting more compensation to hold even the best quality debt, reflected by the US 1oyr Treasury note (UST) trading with a yield of over 5% in mid-October.

The landscape changed noticeably in the latter half of October when US data started to show a more consistent easing of inflation and crucially, a slowdown in the employment market. Wage rises have been a major driver of inflation globally as many left the workforce after Covid and employers have struggled to fill vacancies. It is a harsh truth that a healthy economy needs a degree of unemployment as competition keeps wage growth in check, when this is absent workers, unsurprisingly, demand higher wages and the inflation spiral continues.

December: markets buoyed by US roadmap for potential rate cuts

As the data continued to show inflation slowing, bond yields moved lower (and due to the inverse relationship, prices higher) throughout November and into December, but it was the comments from the Chair of the Federal Reserve (the Fed) on December 13th that sent markets into overdrive. In his regular monthly commentary Jerome Powell unexpectedly changed his rhetoric from cautioning that rates would remain elevated for some time, to setting out a roadmap for potential rate cuts in the coming year – the long awaited “Fed Pivot”. This new stance was extremely positive for markets and the UST 10yr yield fell to below 4%, a movement of around 1.25% without any change in base rates.

While other central banks gave fewer indications that they were nearing a pivot point – indeed at the December meeting of the Bank of England (BOE) monetary committee, three members voted to increase rates – data in both the UK and Europe shows inflation easing and the economy contracting. The central banks are always trying to balance economic growth vs inflation and the danger remains that they are too slow in stimulating the economy and will cause a recession. As mentioned above, the US economy has been surprisingly robust and while the UK and Europe showed less strength than this, the regions have to date avoided the recession that many felt inevitable last year. However, more recent data has shown that parts of Europe are now on the cusp of recession with Germany being a particular concern. While inflation is not fully defeated the question is when the balance tips to the need to deliver economic growth. While it is usually the case that where the US goes others follow, it is a distinct possibility that the first central bank to cut rates may be the ECB.

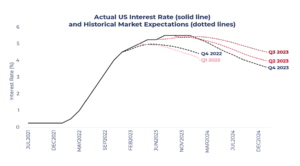

The uncertainty over the path of inflation and central banks policy led to large changes in the projected course of future interest rates over the year as shown in the graph below. The most telling data point looks to be the difference between Q3 and Q4 projections with the latter seeing rates fall steeply over 2024. The Federal Reserve have plotted for 3 rate cuts next year, but the market believes there will be more, potentially up to 6. As always, the actual path will be dependant on many different factors and the truth will probably be somewhere between the 2 forecasts. Whatever the eventual outcome, there is certainly more confidence that we will see lower borrowing cost next year.

Source GuinnessGI and Bloomberg

Higher interest rates: a more rational position

Fixed interest (bonds) will be the most obvious beneficiary of lower interest rates. Much as rising yields forced prices lower, so the reverse will be true with valuations going up as yields fall. December saw a significant (perhaps overdue) rally across bond funds and on risk/reward basis the asset class is very attractive. Bond managers are taking this opportunity to lock in rates that have not been seen for several years. For example, at the beginning of 2022 the 5yr UK Gilt yield was about 0.7% and it is now 3.7%, this is a significant movement in a short space of time for the usually staid bond market.

Within the sector our preference is for investment grade (or better quality) and sovereign debt. There is always the temptation to look further along the risk curve to the returns offered by the high yield market, but with the potential for an increase in defaults when heavily indebted (and low profit) companies have to refinance at a higher rate of interest, this area isn’t as attractive. There will be pockets that do well here of course, and we trust our managers to be selective in any bonds they buy.

While the speed at which central banks increased interest rates is possibly questionable, what is certainly true is that after the era of low or zero interest rates we have moved back to a situation where there is a cost to borrowing. This is a far more rational position and should allow markets to return to what was the status quo pre the great financial crisis (2007/8) and Quantitative Easing (QE). A healthy economy depends on competition and free money allowed too many “zombie” companies to continue despite not making profit.

A further benefit to this new regime is that bonds have the potential to return to the traditional role as a diversifier from equity risk. Pre QE equity and bond markets broadly moved in different directions, as equity markets rose, and economies overheated central banks were able to raise interest rates to cool the economy and vice versa. For the past 10 years the asset classes were more closely correlated and moved in the same direction, this was less of a problem when both went up, but it eventually led to situation we saw in 2022 when markets reversed and there was little in the way of a safe haven.

The drop in bond yields has also had an immediate effect on the returns available on cash deposits which have fallen since the highs of the summer. If interest do fall as predicted, then these downward movements will accelerate.

Positive returns from equities in the last quarter distorted by the Magnificent 7

Equities have also broadly followed the movement in yields this with the higher for longer mantra being a headwind to most parts of the market. This sector therefore also benefitted greatly from the Fed pivot and delivered positive returns in the last quarter having been patchy for the year prior to this.

It is not possible to discuss the equity market without mention of the performance of just a few stocks this year which have very much distorted markets. The so called “Magnificent 7” (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta and Tesla) between them accounted for around 60% of the gain in the S+P 500 index in 2023, a figure that was far higher in October before the broader end of year rally. The size and domination of these firms is unprecedented, for example Apple alone has a market capitalisation that is greater than all the companies in the FTSE 100 combined, meaning that movements in their share prices are magnified across the indices. Much as this was a big positive last year, the opposite was the case in 2022 when these companies all saw severe reversals, in fact, even after the rise in valuations four of the companies, Tesla, Amazon, Meta and Alphabet are below their 2021 highs.

The question is whether these companies can continue this trajectory and monetise the potential of AI and it seems likely that while the prospects generally look good, it may be more selective going forward. The most obvious example being Tesla which is under pressure from Chinese Electric Vehicle (EV) manufacturers and is seeing slower progress on battery manufacturing developments. Telsa is also very dependent on its owner and with his purchase of Twitter looking less wise by the week, Elon Musk’s star is perhaps waning. It would be a foolish call to write off the man behind two of the most success companies of the millennium to date (Musk was also a founder of Paypal) but there have certainly been some questions raised recently.

What does seem likely is that the benefit of AI will be felt across a broader range of firms and while the “enablers” listed above that will provide the infrastructure for the technology look likely to continue to prosper, others may start to be able to use AI to increase market efficiencies. An early example of this is that the language learning app, Duolingo, recently cut the number of translators it employs by 10%. While there is clearly a human cost here, not only in unemployment but also the potential fall in tax revenue as more companies adopt the technology, from an economic point of view this will lower the companies cost base and should increase profitability.

Geopolitical tensions and likely election results dominate the outlook for 2024

Geopolitics continue to have an impact on markets and remain extremely hard to predict. There is no sign of a ceasefire in Ukraine and although the energy market has stabilised and storage over the summer mean that there isn’t currently the heightened fear of the lights going out, the situation remains delicate. The Israel/Hamas conflict has increased concerns over the stability of the region and recent attacks by Houthi terrorists on shipping has only added to the tension. From an economic point of view the main issue is over what these events might do to the supply and therefore cost of oil, a spike in which would be inflationary and has the potential to change the interest rate landscape once again.

Well over half the worlds population will head to the voting booth this year and while some outcomes are not in doubt (Putin will win as will Modi in India) elections elsewhere will be closely monitored. Nowhere will be more the case than in Taiwan where the result, and more especially China’s reaction to it, will be significant.

In the EU there looks like being a move to the right which may bring more Euroscepticism from some areas and in the UK, it seems highly likely that we will see a change in government at some point this year.

However, the main political event this year will be the US Presidential Election in November which seems increasing likely to be a rerun between Biden and Trump, the result of which is likely to have widespread market ramifications.

16 January 2024

Important Information

The material in this article is for information only. The article is for UK residents only. It is the property of MKC Wealth Limited and should not be distributed without prior permission from this business. The information contained in this article is based on our interpretation of HMRC legislation which is subject to change. The value of your investments and the income from them may go down as well as up and neither is guaranteed. Changes in exchange rates may have an adverse effect on the value of an investment. Changes in interest rates may also impact the value of fixed income investments. The value of your investment may be impacted if the issuers of underlying fixed income holdings default, or market perceptions of their credit risk change. There are additional risks associated with investments in emerging or developing markets. Investors could get back less capital than they invested. Past performance is not a reliable indicator of future results. MKC Wealth Ltd does not provide taxation advice. Taxation advice is not regulated by the Financial Conduct Authority.