< Back to Learning & Insights

Bouncing back: 3 reasons it’s important to ignore short-term market volatility

Even though trampolining and investing may seem worlds apart, they do share one unexpected similarity: they both tend to bounce, albeit in varied ways.

In recent years, markets worldwide have witnessed significant volatility and uncertainty spurred by global events, namely the Covid-19 pandemic, Russia’s invasion of Ukraine, and high interest and inflation rates.

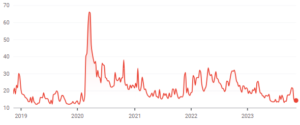

Examining the movement of the CBOE Volatility Index highlights this market uncertainty, as dramatic movements indicate higher volatility levels, as seen in the chart below:

Source: Google Finance

As you can see, the index has fluctuated considerably over the past few years, especially during notable events such as the pandemic in 2020 or the war in eastern Europe at the start of 2022.

While markets have been relatively volatile in recent years, it may be worth ignoring any dramatic price swings as much as possible, as the long-term benefits of investing often outweigh the short.

So, with the FIG World Trampoline Championships taking place in Birmingham this November, now may be the perfect time to examine three reasons why ignoring short-term market volatility and staying invested could help your portfolio bounce back.

1. Markets historically recover

When markets are uncertain, and the value of your investments starts to fall, it can be easy to see this as a one-off event. However, if you look back at past data, it’s clear that periods of volatility occur regularly.

Indeed, the chart below shows a timeline of significant events that have affected the market, based on the MSCI World Price Index from 1988 onwards:

Source: Humans Under Management

As you can see, several major global events have resulted in significant market drops through the years. Despite this, the chart shows that the general trend over the past 30 years has been upward.

Data from Schroders highlights this further, indicating that “market corrections” – where the prices of shares drop by 10% – occurred in US Markets in 28 of the last 50 calendar years to 2022. Even with these dips, the market still returned an average of 11% each year in the previous 50 years.

This shows that it’s essential to take a “big picture view” of markets and remember that, when undergoing a period of uncertainty, they tend to bounce back eventually.

2. Time in the market, not timing the market

In response to a sudden drop in value across the market, it can be tempting to sell your investments with the idea of buying them back when they reach their lowest point.

However, this is an incredibly difficult practice, as predicting exactly when markets will change is complex, and even professionals struggle to do so. As well as being quite complicated to time markets, you could also miss out on days of significant growth, and the overall value of your portfolio could fall as a result.

In fact, data from Schroders highlights the fact that even missing a handful of the best-performing days on the market could mean you lose out.

The data – which is represented by the returns of an investment of £1,000 between 1986 and 2021 – shows that if you’d invested in the FTSE 250 and missed out on just 30 of the market’s best-performing days over this 35-year period, it would cost you roughly £33,000.

Moreover, knee-jerk reactions to short-term volatility could mean that, in time, you form a “toxic relationship” with the market, dissuading you from reinvesting in the future. Research published by CNBC shows that 30% of those who sold their investments in an emotional response to market dips never invested again.

Instead of selling your investments in response to a period of uncertainty, it may be worth holding your course and riding it out. After all, it’s as the saying goes: “Time in the market, not timing the market”.

3. A long-term investing perspective could mean less risk overall

Surprisingly, ignoring short-term market volatility and holding a long-term outlook of returns could mean that you incur less risk in general.

This is because the ups and downs of markets tend to “smooth out” over time, meaning that the longer you invest for, the less risk of losing money there has historically been. This is why it’s often prudent to hold your investments for five or more years.

Just remember that all investing carries some level of risk, and the value of your investments can fall.

Data from Nutmeg shows how your risk of losing money falls overall when you invest over longer periods of time. If you invested your money in the global stock market on a random day between 1971 and 2022, and held that investment for two years, your probability of loss would roughly be 20%.

Meanwhile, if you retained that investment for 10 years, your probability of loss would drop to almost 5%. Hold onto it for 15 years, and your chance of loss would fall even further to almost 0%.

Even if you think about withdrawing from markets due to short-term volatility, leaving your money invested could actually mean that you’re giving it the greatest opportunity to grow.

So, if you happen to watch the World Trampoline Championship this year, just remember that, much like the graceful trampolinists, markets typically bounce back eventually.

Get in touch

If you’re struggling to ignore short-term volatility and are worried about the performance of your investments, then we can help.

To find out more, please email enquiries@mkcwealth.co.uk or call 020 8946 8185 to get in touch.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.